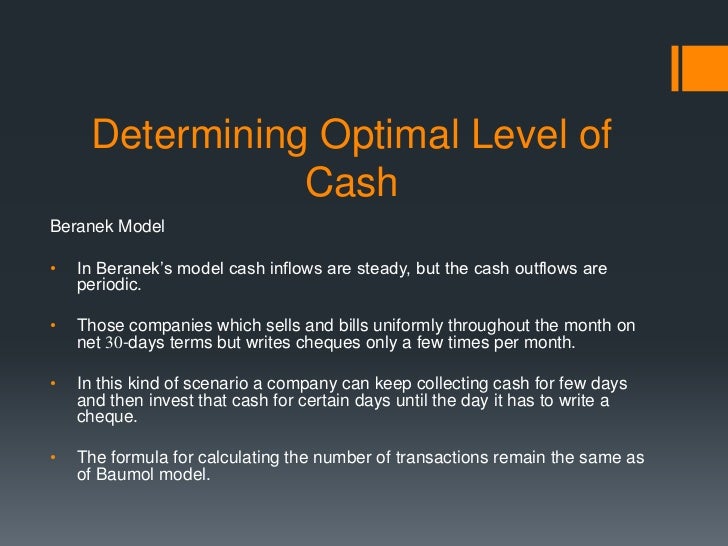

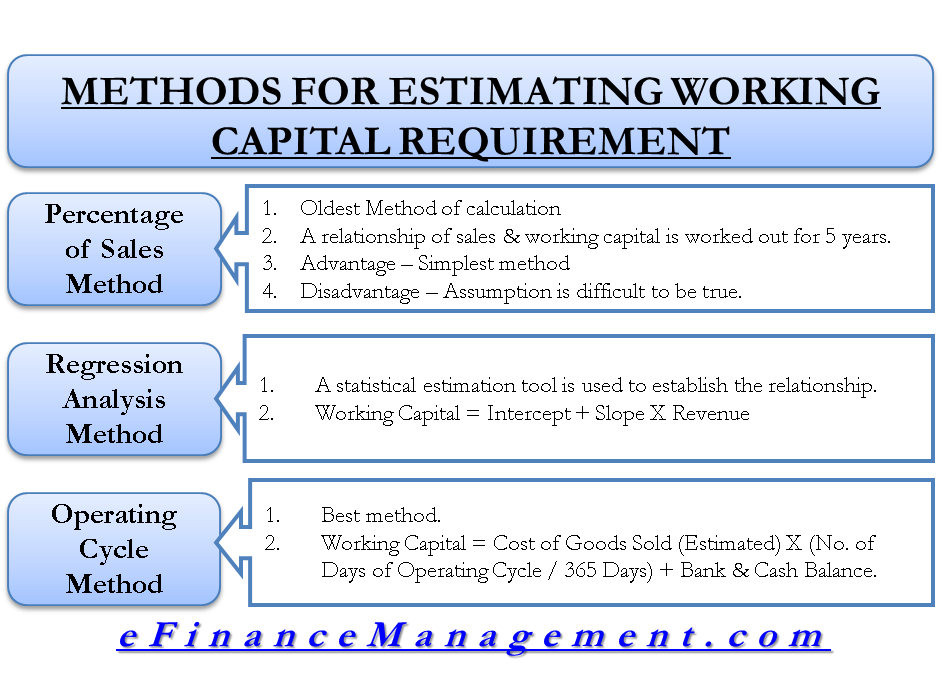

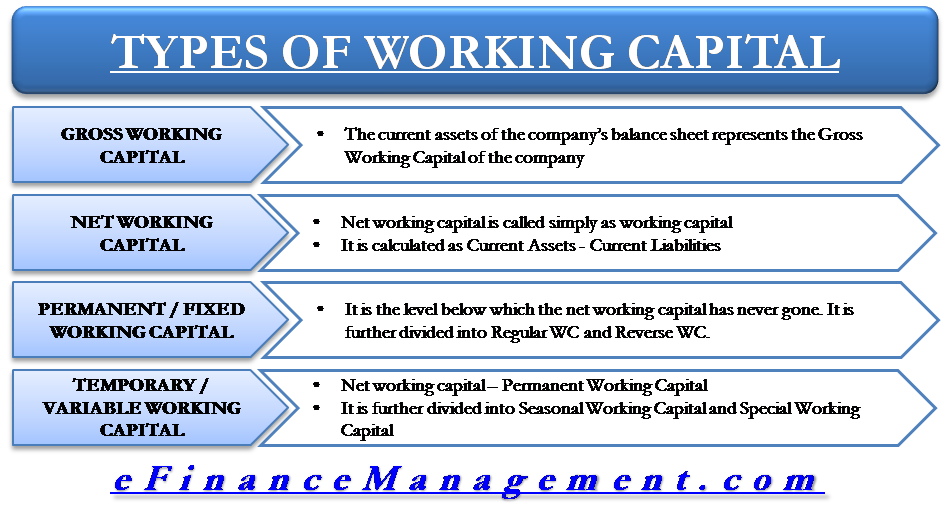

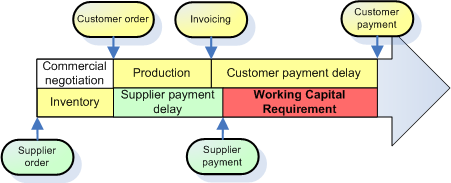

/9/19 · Working Capital Requirements Formula The working capital equation can be written as follows Working capital = Inventory Accounts receivable – Accounts payable While this formula applies to any business, for a manufacturer inventory is more complicated and is made up of three components Raw materials Work in process (WIP)1/8/09 · Working capital can be divided into two viz Permanent and Temporary Permanent working capital is the level of working capital which is always required and maintained Temporary working capital is the part of working capital which keeps on fluctuating It is high in good seasons and low in bad seasons There are two types of financing availableADVERTISEMENTS There are four methods for estimating the working capital requirements of a firm The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 4 Individual Components Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its

How To Calculate Working Capital With Calculator Wikihow

Level of working capital formula

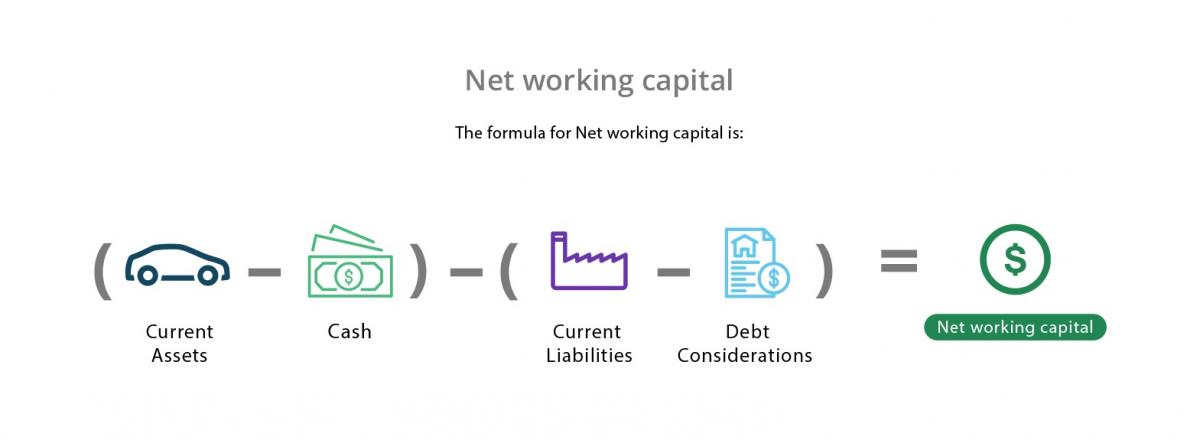

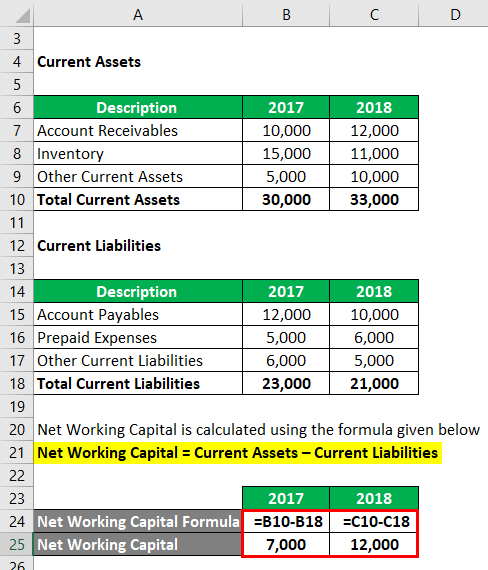

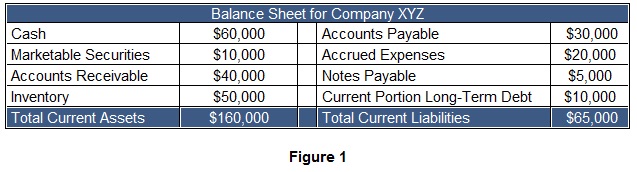

Level of working capital formula-Working capital (also known as net working capital) is defined as current assets minus current liabilities Therefore, a company with $1,000 of current assets and $90,000 of current liabilities will have $30,000 of working capital A company with $100,000 of current assets and $100,000 of current liabilities has no working capital9/1/16 · Working Capital Meaning • Working capital typically means the firm's holding of current or shortterm assets such as cash, receivables, inventory and marketable securities • These items are also referred to as circulating capital • Corporate executives devote a considerable amount of attention to the management of working capital

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Nwc Definition Formula And Examples

Negotiating working capital targets and definitions Prepared by Robert Moore, Partner, RSM US LLP bobmoore@rsmuscom, 1 847 413 6223 The textbook definition of working capital is the difference between current assets and currentThe following points highlight the top five methods for estimating working capital requirements, ie, 1 Percentage of Sales Method 2 Regression Analysis Method 3 Cash Forecasting Method 4 Operating Cycle Method 5 Projected Balance Sheet Method Estimating Working Capital Requirement Method # 1 Percentage of Sales MethodWorking Capital Financial management is an important activity with a vital role in organizing, planning, controlling, and monitoring of business resources It helps organizations to use their financial resources in a more efficient way to achieve their goals and objectives The branch of financial management which deals with the efficient

The amount of the working capital shall be maintained at such level, which is adequate for it to run its business operations, neither excessive nor inadequate This level of working capital is called as the "Optimum Working Capital" Liquidity Vs Profitability The level of working capital affects the degree of risk and profitability bothCurrent liabilities are due within 12 months The standard formula for working capital is current assets minus current liabilities Working capital that is in line with or higher than the industry7/4/ · The working capital formula is Working Capital = Current Assets – Current Liabilities The working capital formula tells us the shortterm liquid assets available after

26/6/21 · By adding together the totals for current assets and current liabilities in the balance sheet, a very important figure can be calculated – working capital Working capital = current assets less current liabilities Working capital provides a strong indication ofWorking Capital Cycle = 85 – 90 = 15 ThisWorking capital = Current assets – current liabilities What makes an asset current is that it can be converted into cash within a year What makes a liability current is that it is due within a year As a working capital example, here's the balance sheet of Noodles & Company, a fastcasual restaurant chain As of October 3, 17, the

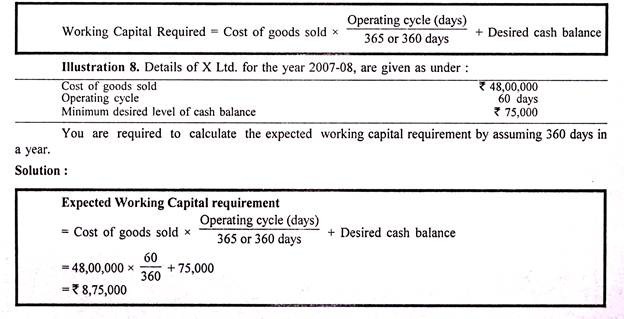

Working Capital Example Formula Definition Wall Street Prep

Www Msuniv Ac In Download Pdf 6798ccc

31/5/21 · Determining a Good Working Capital Ratio The ratio is calculated by dividing current assets by current liabilities It is also referred to as the current ratio9/5/14 · The following formula can be used to estimate or calculate the working capital Working Capital = Cost of Goods Sold (Estimated) * (No of Days of Operating Cycle / 365 Days) Bank and Cash Balance If the cost of goods sold (estimated) is $35 million and operating cycle is 75 days and bank balance required is 125 million · Now, lets us apply the formula to determine the working capital of Max Electronics Working Capital = Current Asset Current Liabilities 72,26,215 – = 35,25,869 The working capital of Max Electronics is 35,25,869 Types of working capital management ratios

Estimating Working Capital Requirements Solved Problems Finance Strategists

4 Tips For Effectively Managing Working Capital Softco

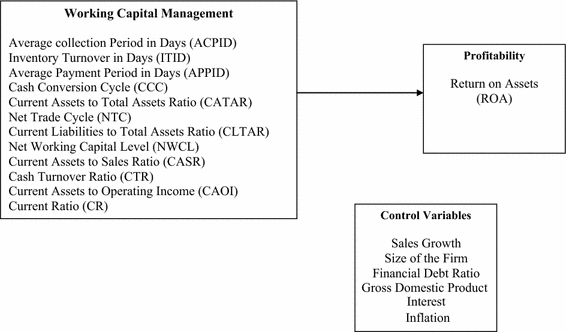

8/2/21 · What is the Sales to Working Capital Ratio?28/6/10 · Management of Working Capital Working capital in general practice refer to the excess of CA over CL Management of working capital therefore is concerned with the problems that arise in attempting to manage the CA, the CL and the interrelationship that exists between them The basic goal of WCM is to manage the CA & CL of a firm in such a way that a satisfactory levelIt usually takes a certain amount of invested cash to maintain salesThere must be an investment in accounts receivable and inventory, against which accounts payable are offset Thus, there is typically a ratio of working capital to sales that remains relatively constant in a business, even as sales levels change

Net Working Capital Formula Examples Calculation Youtube

Overview Of The Working Capital Financing Decision Boundless Finance

11/8/ · Working Capital Ratio Formula Alternatively, you can calculate a working capital ratio This is done simply by dividing total current assets by total current liabilities, to get a ratio such as 21 (twice as much in assets) or 11 (equal assets and liabilities) Current Assets ÷ Current Liabilities = Working Capital RatioYou could also calculate the working capital for each quarter and take an average of the four quarters and plug the result into the formula as average working28/8/ · Working capital, like cash flow, is something that is constantly changing Due of this, to calculate your business's current amount of working capital, you'll need to review your balance sheetIn this blog post, we'll explain how to correctly do this so that you can take charge of your business finances

How To Calculate Working Capital With Calculator Wikihow

Non Cash Working Capital Managementmania Com

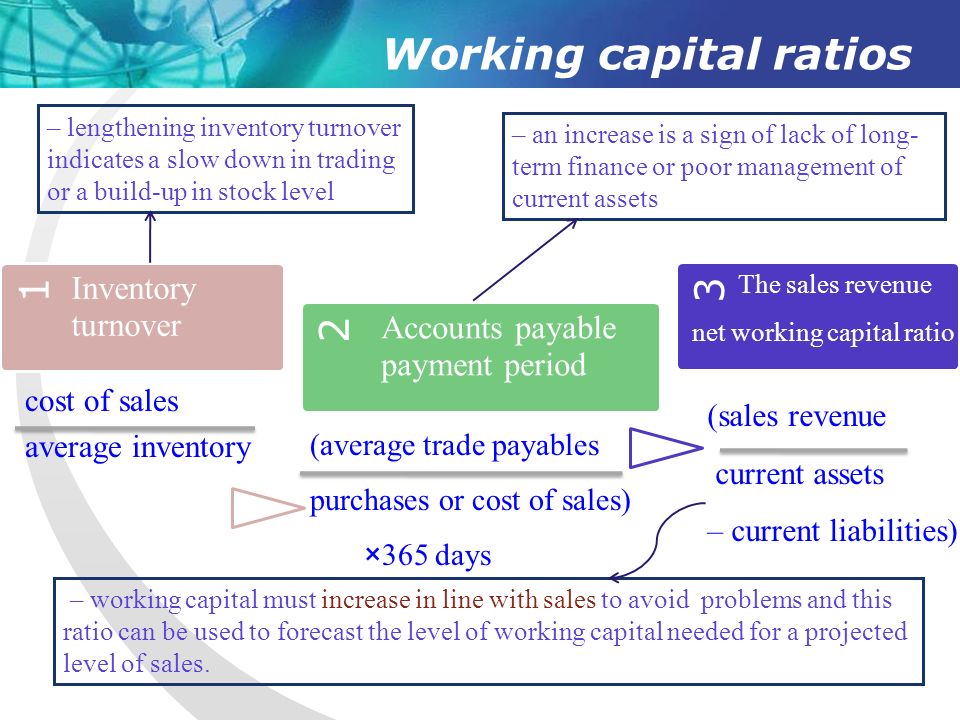

Formula The working capital ratio is calculated by dividing current assets by current liabilities Both of these current accounts are stated separately from their respective longterm accounts on the balance sheet This presentation gives investors and creditors more information to analyze about the company Current assets and liabilities are19/2/18 · One of those key terms is called the working capital target In accounting terms, working capital is equal to current assets minus current liabilitiesWorking Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills?

Working Capital Example Formula Definition Wall Street Prep

How To Calculate Working Capital With Calculator Wikihow

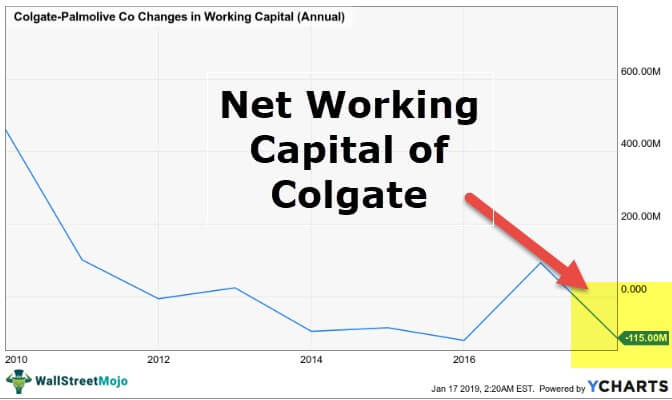

29/6/21 · Hence, a company with a high level of working capital may fail to achieve the return on capital employed (Operating profit ÷ (Total equity and longterm liabilities)) expected by its investors Therefore, when determining the appropriate level of working capital there is a tradeoff between liquidity and profitabilityReceivable days = ;Working Capital Cycle Formula Based on the above steps, we can see that the working capital cycle formula is Working Capital Cycle Sample Calculation Now that we know the steps in the cycle and the formula, let's calculate an example based on the above information Inventory days = 85;

Pdf A 5 Years Systematic Overview Of Working Capital Management Towards Profitability Of Alcholic And Non Alcholic Industries In Rwanda

Working Capital In Valuation

• The balance sheet of a business provides a "snapshot" of the working capital position at a particular point in time14/7/16 · Types of Working Capital Permanent Working Capital – Funds necessary to carry the operations of a business Temporary Working Capital – Seasonal or special requirements for funds Semivariable Working Capital – The fund requirements remains same up to a stage, then increases with sales and time Determinants of Working Capital RequirementPayable days = 90;

Days Working Capital Formula Calculate Example Investor S Analysis

Assessment And Computation Of Working Capital Requirement

Net Working Capital Ratio Formula = Net Working Capital/Total Assets = (Current Assets – Current Liabilities)/Total Assets This ratio indicates the amount of funds invested in fixed assetsThe basic formula for determining working capital involves only two factors First, it is necessary to define the current liquid assets that the company has This may be somewhat different from general assets, since the focus is on those resources that can be converted into cash quickly and easilyNormalized Working Capital definition Normalized Working Capital means the negative amount equal to () €3,238,850 (minus three million, two hundred and thirty eight thousand, eight hundred and fifty euros ) Normalized Working Capital means, with respect to any Person as of any date, the average level of net

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Working Capital Management Components Approaches

To determine what a "normal" level is for NWC, an average of the previous six to 12 months is often used, which may be referred to as the "target" or "peg" At closing, the actual NWC delivered is compared to an agreedupon target and a "trueup" then occurs14/4/21 · At a high level, the calculation of working capital is as follows Current assets Current liabilities = Working capital The working capital figure will likely change every day, as additional accounting transactions are recorded in the accounting systemIllustrative Calculation – Net Working Capital at Transaction Close Versus the Peg Scenario A – Buyer "Pays" Net Working Capital at Close $ 22,500,000 Net Working Capital Peg ,500,000 Excess NWC Buyer Pays the Seller $ 2,000,000

Working Capital Formula How To Calculate Working Capital

Working Capital Net Current Assets Tutor2u

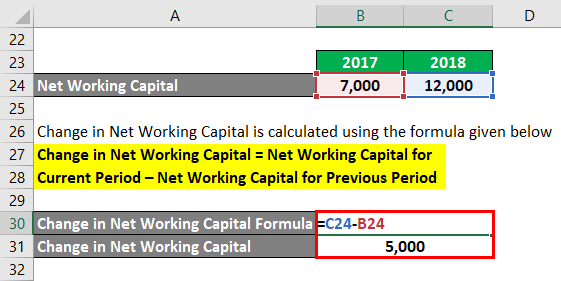

Cash Current assets divided by current liabilities is known as a working capital ratio To calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This indicates whether a company possesses enough shortterm assets to cover shortterm debt2/7/19 · Beyond a formula or equation telling us what working capital is, the important issue is to understand what the change part means and how to interpret it and to be able to use it in valuing companies Difference between Working Capital and Changes in Working Capital Remember that working capital = current assets – current liabilities12/2/21 · Working capital is a reflection of current shortterm financial health It indicates whether a business has enough shortterm assets to cover daytoday operations and shortterm debt But, while similar, WC and cash flow aren't the same Both are critical measurements of financial health Working capital is a snapshot of a present situation

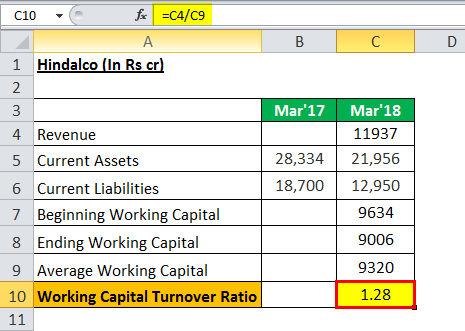

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital With Calculator Wikihow

Working capital Formula Working capital of a business represents its liquidity status, ie, its ability to meet shortterm operational liabilities through assets convertible to cash A business has adequate working capital when its current assets exceed the value of21/6/21 · Working capital is the amount of money a company has left over after subtracting current liabilities from current assets Working capital tells you if a company can pay it's shortterm debts and have money left over for operations and growth Working capital should be used in conjunction with other financial analysis formulas, not by itself8/6/16 · While the formula can be stated simply as "current assets less current liabilities", capturing the parties' exact intentions with an effective working capital

How To Calculate Working Capital The Working Capital Formula

Working Capital Cycle Understanding The Working Capital Cycle

5/6/18 · How is net working capital determined?Inventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current assets and total current liabilities is known as working capital or net working capitalWorking capitalADVERTISEMENTS The following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 Operating Cycle Method 1 Percentage of Sales Method It is a traditional and simple method of determining the level of working capital and its components In this method, working

What Is Net Working Capital How To Calculator Nwc Formula

Working Capital Example Meaning Investinganswers

Workingcapital amount They calculate it by determining the target business's average working capital over a defined period, before signing an agreement or term sheet (for example, six or 12 months) Alternatively they may use a presigning balancesheet date as a reference The calculation of target working capital will depend on the historical

Working Capital An Essential Guide For Small Business Iwoca

What Is Working Capital

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Requirements In A Manufacturing Business Plan Projections

4 Tips For Effectively Managing Working Capital Softco

Types Of Working Capital Check Factors Meaning Quickbooks

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Management Wcm Definition Strategies Types Invetopedia

Working Capital Calculation Double Entry Bookkeeping

/current-ratio-analysis-56a0a31d5f9b58eba4b25303.gif)

Analysis Of Liquidity Position Using Financial Ratios

Working Capital Management Wcm Definition Strategies Types Invetopedia

Working Capital Formula How To Calculate Working Capital

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Nwc Definition Formula And Examples

How To Calculate Working Capital Requirement Plan Projections

Working Capital Management Module 1 Introduction Working Capital Or Short Term Finance Refers To Current Assets And Current Liabilities There Are Two Ppt Download

Working Capital The Definition Formula

Working Capital What Is It And Why It S Important

Working Capital Definition Elements Formula Calculation Example Cycle

Enterprise Value To Equity Value Bridge The Excel Bible

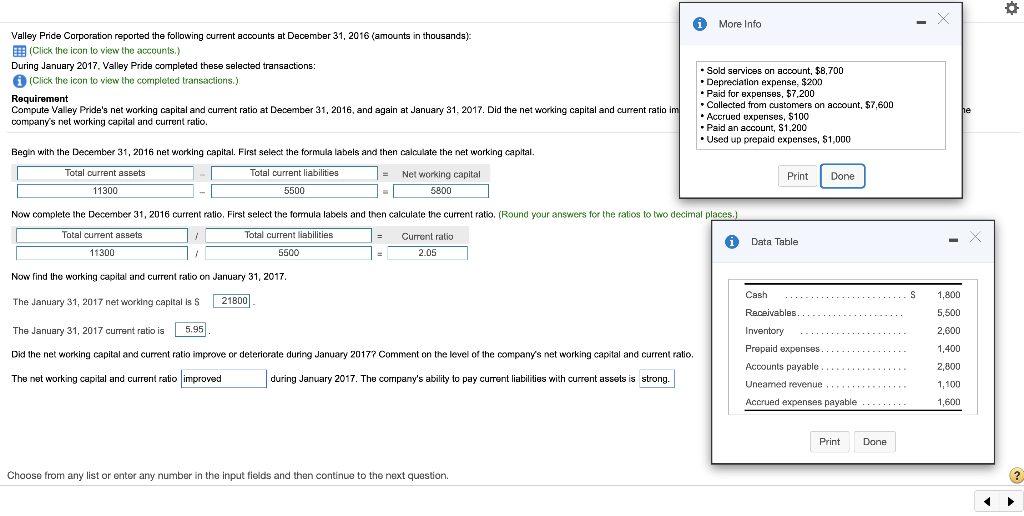

More Info Valley Pride Corporation Reported The Chegg Com

Working Capital Formula How To Calculate Working Capital

Working Capital Investment Capital Investment

Everything You Need To Know About Working Capital

Working Capital What Is It And Why Is It Essential For Business Moula

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Example Formula Definition Wall Street Prep

3

Working Capital Calculation Your How To Guide Fast Capital 360

Resources Uwcc Wisc Edu Finance Balancesheetratios Pdf

Baltimore Corporation Reported The Following Current Chegg Com

Changes In Net Working Capital Step By Step Calculation

Working Capital Definition Elements Formula Calculation Example Cycle

1

Working Capital What It Is And How To Calculate It Efficy

Working Capital Definition Elements Formula Calculation Example Cycle

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

The Working Capital Cycle And Operating Efficiency The Working Capital Cycle Working Capital And Strategic Debtor Management

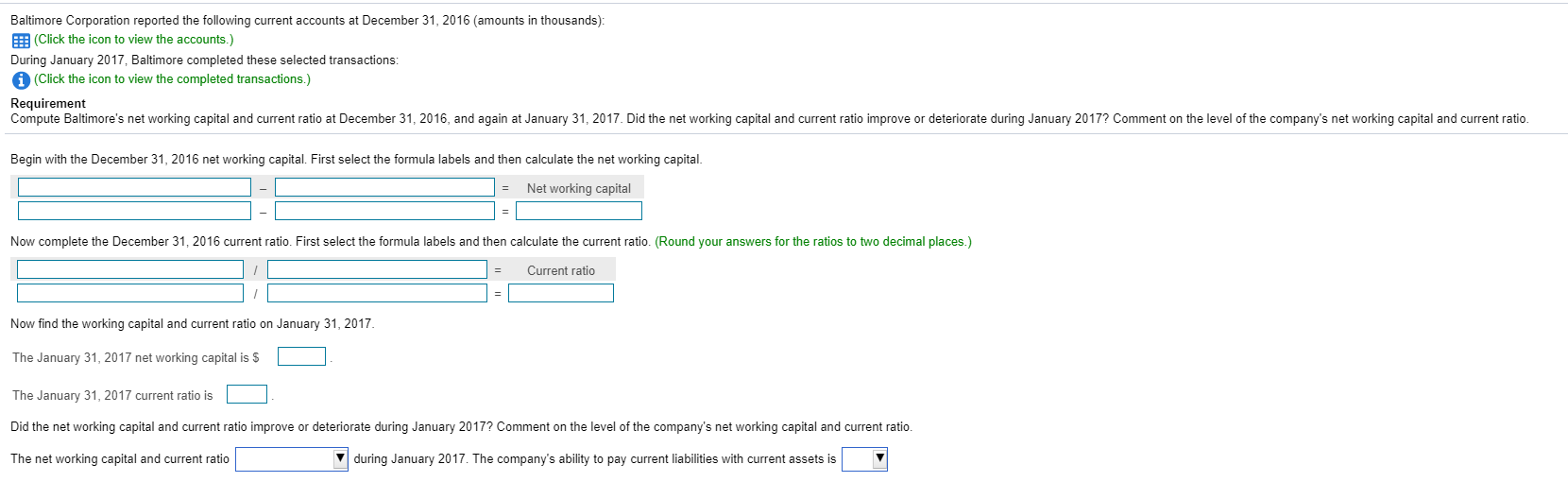

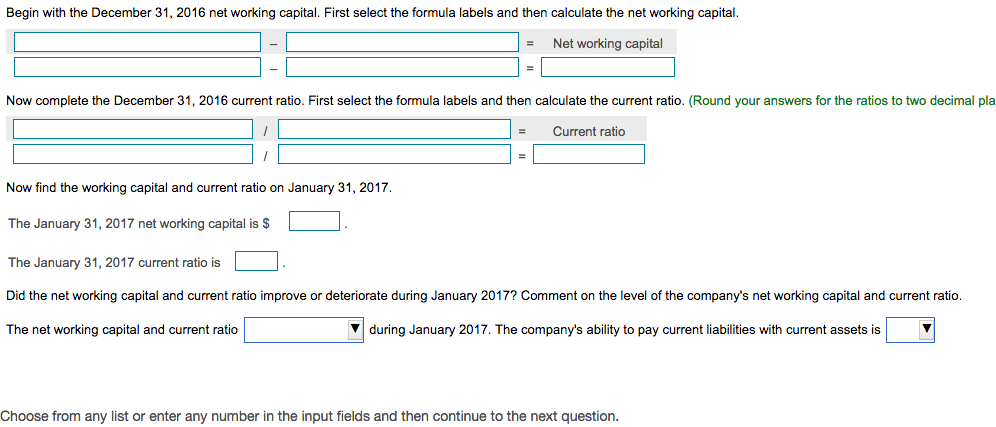

Answered Begin With The December 31 16 Net Bartleby

Chapter 4 Working Capital Ppt Download

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Working Capital What It Is And How To Calculate It Efficy

Net Working Capital Formula Example Calculation Ratio

Cfa Level I Working Capital Management Part I Youtube

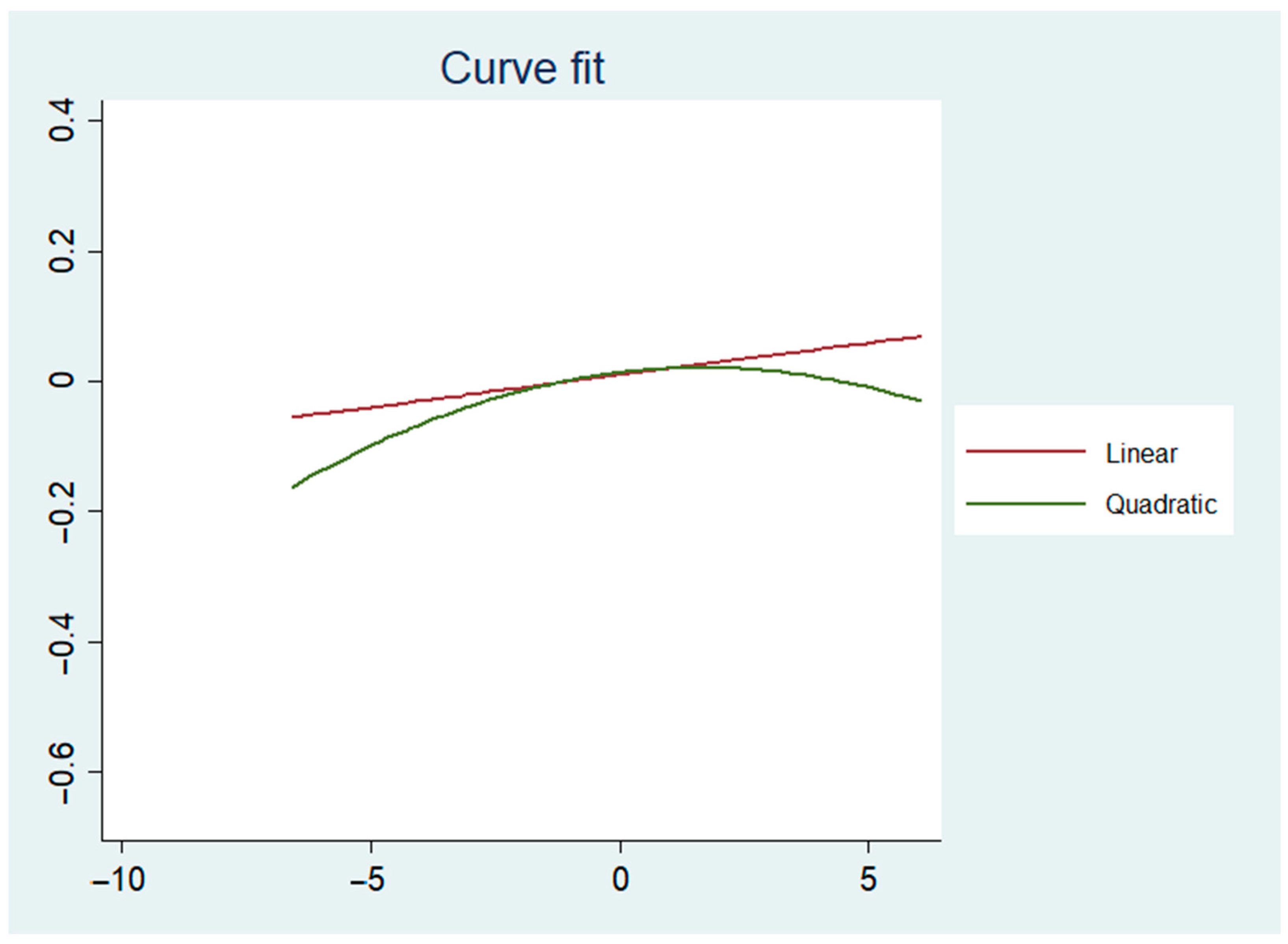

Jrfm Free Full Text The Impact Of Working Capital Management On Firm Profitability Empirical Evidence From The Polish Listed Firms Html

Management Of Working Capital

Working Capital Cycle

Working Capital Formulas And Why You Should Know Them Fundbox

Working Capital Management Acca Global

Methods For Estimating Working Capital Requirement

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Working Capital Calculation Your How To Guide Fast Capital 360

M5 Partnerships Book Pages 251 276 Flip Pdf Download Fliphtml5

Chapter 2 Working Capital Sreyya Yilmaz Ra Working

A Look At The Cash Conversion Cycle

Working Capital Management Components Approaches

How To Calculate Working Capital The Working Capital Formula

Working Capital Financial Edge

What Are Positive And Negative Working Capital And Why They Re Important Brixx

1

Working Capital Management

Types Of Working Capital Gross Net Temporary Permanent Efm

Net Working Capital Formulas Examples And How To Improve It

Working Capital Requirement a Mantra

Change In Net Working Capital Formula Calculator Excel Template

Working Capital And Liquidity Explanation Accountingcoach

:max_bytes(150000):strip_icc()/NetWorkingCapital-4f7d2474ee2242c8a1f82b714cb68315.png)

Net Working Capital What Is It

The Determinants Of Working Capital Management And Firms Performance Of Textile Sector In Pakistan Springerlink

Working Capital Formulas And Why You Should Know Them Fundbox

Scielo Brasil Key Factors In Working Capital Management In The Brazilian Market Key Factors In Working Capital Management In The Brazilian Market

1

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Formula Calculations Examples And Tips India Dictionary

The Working Capital

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Management Acca Global

Working Capital Formula Calculator Excel Template

Changes In Working Capital Fcf And Owner Earnings

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Example Meaning Investinganswers

0 件のコメント:

コメントを投稿